As we approach 2026, several key factors continue to influence Commercial Property Insurance pricing and availability across the U.S.:

🔹 Rising Construction Costs

Material and labor expenses remain roughly 40% higher than pre-2020 levels, pushing up replacement costs and premiums.

🔹 Catastrophe Losses

Weather-related incidents caused over $112 billion in insured losses in 2024, keeping sustained pressure on both property insurers and reinsurance markets.

🔹 Reinsurance Stabilization

While reinsurance capacity has improved compared to prior years, primary carrier pricing continues to reflect ongoing catastrophe exposure and volatility.

🔹 Labor Shortages

Rebuilding and repair delays are extending recovery timelines and driving higher business interruption costs.

Despite these ongoing challenges, improvements in reinsurance capacity and supply chain stability are gradually helping the market move toward equilibrium.

🔹 Key Takeaway on Commercial Property Insurance 2026

The industry is transitioning into a more stable phase — but the need for precise valuations, robust risk management, and proactive renewal strategies has never been greater.

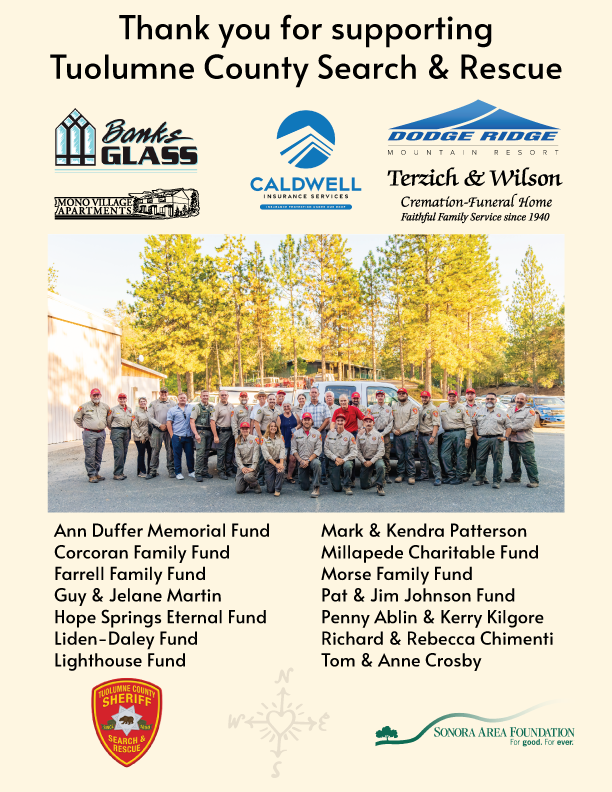

Learn more about our Commercial Property Insurance coverage options at Caldwell Insurance Services in Sonora, CA.

For guidance on protecting your commercial property in 2026, contact Caldwell Insurance Services in Sonora today.